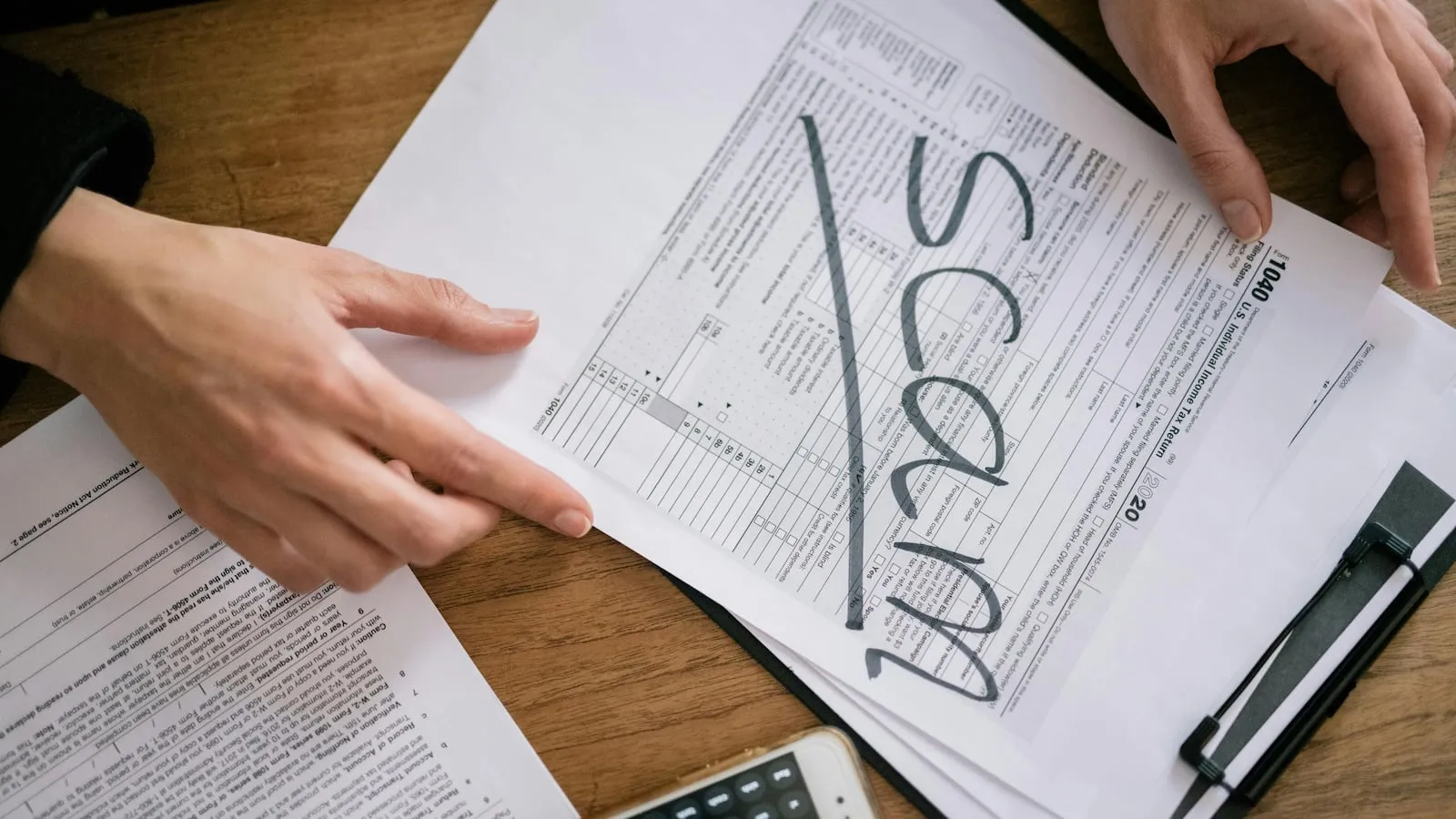

Three Charged with Fraud in Smart Prime Group Investigation

The Ontario Securities Commission (OSC) has announced that three individuals have been charged with fraud in connection with an investment scheme operated by Smart Prime Group, an unregistered asset management firm based in Ontario. The charges stem from an investigation that revealed fraudulent activities involving 28 investors who were misled regarding the handling of their funds.

On December 10, 2025, Seyed Mohammad Ali Nojoumi, Behnaz Samavat, and Amir Mostoufi were charged with fraud exceeding $5,000 and possession of proceeds of crime, in violation of the Criminal Code. The OSC alleges that the operators of Smart Prime Group promised investors that their money would be placed in individual trading accounts. However, instead of being invested as promised, the funds were diverted to personal accounts and used for unrelated expenditures.

The OSC's investigation began as a probe into an affinity investment scheme in York Region, further aided by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). The financial intelligence provided by FINTRAC was instrumental in uncovering the misappropriation of funds.

Notably, the OSC has highlighted that neither Smart Prime Group nor its operators are registered to sell securities in Ontario, which raises significant concerns regarding the legitimacy of their operations. The OSC aims to protect investors from fraudulent practices and to maintain integrity within capital markets.

Mostoufi and Samavat had previously been arrested and released. They are scheduled to appear in court on January 8 and January 22, 2026, respectively. Nojoumi was arrested and charged on the same day as the OSC's announcement and is currently awaiting a bail hearing.

The OSC has emphasised the importance of investor vigilance, advising individuals to verify the registration of any entity or person offering investment opportunities. The OSC provides resources to help investors make informed decisions, which can be accessed on their official website.

The Ontario Securities Commission is tasked with ensuring fair and efficient capital markets, as well as fostering investor confidence. Their enforcement division investigates securities-related fraud and aims to deter misconduct that undermines market integrity.

This case serves as a reminder of the potential risks associated with investment schemes and the necessity for regulatory oversight in protecting investors from fraudulent activities.

Guatemala modernizing money laundering laws to avoid international sanctions

Turkish Crypto Platform ICRYPEX Under Investigation for Money Laundering

Italy seizes €486 000 in investigation into money laundering

UK Sounds Alarm on New Money Laundering and Terrorist Financing Threats